Learn how to use the 50/30/20 rule to simplify your monthly budgeting in 2025. Discover real-world examples, tools, and international tips for smart money management.

1. Introduction: Why Budgeting Feels Hard (Until You Simplify It)

Making a budget might feel difficult, particularly if you’re managing debt, obligations, or irregular income. “Where is all my money going?” is a question you might have. In actuality, most people don’t budget because they believe it calls for intricate spreadsheets or a strong understanding of finance. The good news is that you don’t require either.

Presenting the 50/30/20 rule, a budgeting technique that is so easy to understand and can be applied by anyone, wherever in the world. a basis of just three categories, this rule assists you in tracking, organizing, and prioritizing your expenditure. This blog will discuss how this approach functions, practical uses around the world, and how you can customize it to make your money work for you.

2. What Is the 50/30/20 Rule? A Simple Breakdown

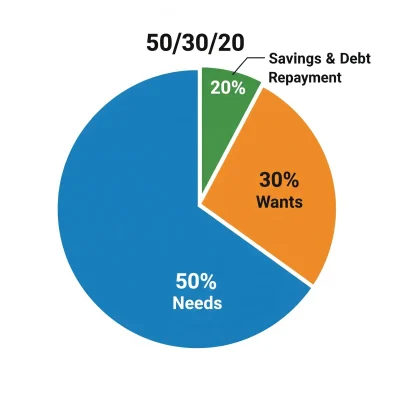

- A structure for money management known as the 50/30/20 rule separates your monthly income into three main areas of expenditure:

- 50% goes for necessities, which include things like rent, groceries, utilities, insurance, and transportation.

- 30% for wants, such as hobbies, vacations, streaming services, and eating out.

- 20% goes toward debt repayment and savings, including emergency funds, loan EMIs, and retirement funds.

The formula

If your monthly income is $3,000:

$1,500 = necessities

$900 = Desires

$600 = Debt & Savings

3. Why This Rule Works for Any Income Level

This rule works well regardless of your monthly income, whether it’s ₹30,000 or $30,000.

Why?

- It is based on percentages rather than absolute values.

- It promotes self-control without causing hardship.

- It fosters long-term stability by teaching financial awareness.

- You will still develop the habit even if you are unable to save 20% at this time.

- Additionally, your savings and financial confidence will increase in tandem with your salary.

4. Category 1 – 50% Needs: What Truly Counts as a “Need”?

Many individuals mistake needs for wishes, yet necessities are non-negotiable. What qualifies is as follows:

✅ Mortgage or Rent

✅ Basic Clothing (weather-appropriate, workwear) ✅ Transportation (gas, metro, bus passes) ✅ Grocery (not snacks, not Starbucks)

✅ Health, life, and auto insurance

✅ Loan EMIs (only the bare minimum needed)

- Steer clear of these mistakes:

- Renting more than 30% of one’s income

- signing up for a premium delivery or shopping service as a “need”

- A tip is to audit your monthly spending and classify every line item. The number of so-called “needs” that are optional upgrades will surprise you.

5. Category 2 – 30% Wants: Spend Guilt-Free but Smartly

You should carefully spend money on the things you want since they make life more joyful. What goes here is as follows:

✅ Memberships to the gym (unless medically necessary),

✅ Netflix, Spotify, and YouTube Premium

✅ Takeout and dining out

✅ Buying devices and clothing, Gifts, hobbies, and vacations

Personal Approach:

- Put experiences before material possessions.

- Try the “One Luxury Rule”: Pick one main desire each month.

- Remember that most people overspend on wants. To prevent using up your savings, keep it at 30%.

6. Category 3 – 20% Savings & Debt Repayment: Your Financial Safety Net

This is the foundation of your future security.

Your twenty percent should be used for:

- Accumulating an emergency fund (at least three to six months’ worth of costs)

- Resolving high-interest debt (payday loans, credit cards)

- Investing in retirement accounts, mutual funds, and SIPs

- The 60/20/20 version should be used if

- You already have no debt.

- You wish to expedite your savings.

Advice: Before you buy, set up your savings to be automatically deducted from your paycheck. Not visible means not tempted.

7. Global Application: How the Rule Adapts Across Countries

This rule works globally but may require adjustments based on cost of living and tax structures.

| Country | 50% Needs | 30% Wants | 20% Savings & Debt |

|---|---|---|---|

| India | ₹15,000 | ₹9,000 | ₹6,000 |

| USA | $1,500 | $900 | $600 |

| UK | £1,200 | £720 | £480 |

| Philippines | ₱15,000 | ₱9,000 | ₱6,000 |

Adapting the rule:

In high-cost cities (like Mumbai, NYC, or London), housing may exceed 50%. Adjust wants accordingly.

In low-cost cities, you may save more. Use that to build wealth faster.

8. Customizing the Rule for Freelancers, Couples, and Families

No two budgets are the same. Here are some ways that various groups can adapt:

- Freelancers: Make use of the average income for three months. Create a “buffer” category to account for erratic cash flow.

- Families should combine their incomes. Plan together rather than individually. Success is shared when goals are shared.

- 💑 Couples: Decide on fixed contributions, such as each budgeting 50% of income.

- The 50/30/20 core remains the same; it is only adjusted for responsibilities and life stage.

9. Common Mistakes People Make with the 50/30/20 Rule

- Failing to recalculate income following a job change or raise

- Making wants (like eating out) into needs

- Savings are neglected due to short-term objectives.

- Seeking perfection rather than consistency

How to Correct:

- Set reminders on your calendar to check your budget every month.

- Make use of budgeting applications such as Walnut, Goodbudget, or YNAB.

- Be adaptable; you may save less in certain months, but over time, consistency will win out.

10. Real-Life Examples: Monthly Budget Breakdowns

🧑💼 Indian Example (Income: ₹50,000/month)

Category Allocation Description Needs ₹25,000 Rent, groceries, transport Wants ₹15,000 Streaming, eating out, shopping Savings ₹10,000 SIPs, emergency fund 👩🎓 US Example (Income: $4,000/month)

Category Allocation Description Needs $2,000 Rent, insurance, bills Wants $1,200 Dining, gym, travel Savings $800 Roth IRA, debt repayment

11. Tools and Apps to Automate Your 50/30/20 Budget

- You require A Budget (YNAB) is an excellent tool for rule-based and zero-based budgets.

- Mint: Bank account links for convenient tracking

- The envelope-style approach to good budgeting

- Walnut (India): Tracking expenses and integrating SMS

Advice: To ensure that savings occur before spending starts, set up auto-debits on payday.

12. What If You Can’t Follow the 50/30/20 Rule Exactly?

- For cities with a high cost of living, 60/20/20

For aggressive debt repayment, 70/10/20 - 50/20/30: Spend less if you wish to invest more.

- Life occurs. Perhaps you’re paying back college loans, or your rent takes up 60% of your salary. It’s alright.

- Changes to Take Into Account: The regulation is merely a recommendation, not a jail term. Intentional expenditure, not perfection, is the aim.

13. Benefits You’ll See Within 30 Days of Consistent Budgeting

- Transparency on the use of your funds.

- Less financial strain

- Better credit practices

- Improved judgment (less impulsive buying)

14. Frequently Asked Questions (FAQs)

Q: Is the 50/30/20 rule good for low-income earners?

Yes. It helps set priorities and reduce lifestyle inflation as income grows.

Q: Can I use this rule with irregular income?

Absolutely. Use average monthly income or base it on your lowest month to be safe.

Q: Is this rule better than zero-based budgeting?

It’s simpler and better for beginners. Advanced users may prefer zero-based for more control.

15. Conclusion: Start Small, Stay Consistent, and Watch Your Finances Improve

Choosing where your money goes rather than wondering where it went is the key to financial mastery; it does not imply losing happiness.

The 50/30/20 rule offers control, simplicity, and mental tranquility. This approach is effective whether you’re in the US, India, or another country because it’s based on values rather than coercion.

Begin this month. Keep track for three months. Make any necessary adjustments. You’ll be astounded by the outcome.