Tired of Annual Fees? Discover India's Best Lifetime FREE Credit Cards!

Unlock Financial Freedom, Earn Rewards, and Build Your Credit Score - All with Zero Annual Fees, Forever.

Ready to Stop Paying Annual Fees?

👉 Compare & Apply Now!Compare India's Top Lifetime FREE Credit Cards

IDFC FIRST Credit Card

Issuer: IDFC Bank

Key Benefits: 300+ Merchant offers & dining discounts all year long

Pros: Upto 10X Reward Points on your spending.

Cons: Minimum Cibil Score Required

Min. Salary (Approx.): 25,000/month

Approval Rate: Highest

RBL Bank Shoprite Credit Card

Issuer: RBL Bank

Key Benefits: Earn 20 reward points for every Rs 100 spent on Grocery shopping.

Pros: Excellent for Amazon shoppers, no upper limit on cashback.

Cons: You must have any Credit Card Before.

Min. Salary (Approx.): 15,000/month

Approval Rate: Moderate to High

AU LIT Credit Card

Issuer: AU Small Finance Bank

Key Benefits: Customizable credit card based on your lifestyle and usage.

Pros: High reward rate, comprehensive benefits.

Cons: Rewards can be complex to understand.

Min. Salary (Approx.): 25,000/month

Approval Rate: High

HSBC Platinum Credit Card

Issuer: HSBC Bank

Key Benefits: Instant discount of upto Rs 500 on Amazon across all categories.

Pros: Great for Premium bookings & Travelling

Cons: Benefits tied to specific partners.

Min. Salary (Approx.): 55,000/month

Approval Rate: Moderate

IDFC FIRST WOW Credit Card

Issuer: IDFC First Bank

Key Benefits: 7.5% Interest on your Fixed Deposit.

Pros:Reward Points that NEVER expire.

Cons: Nothing.

Min. Salary (Approx.): Not Required

Approval Rate: Highest

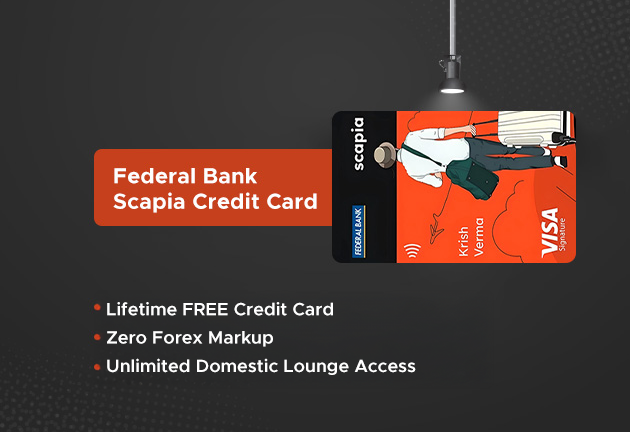

Federal Bank Scapia Credit Card

Issuer: Federal Bank

Key Benefits: Enjoy international transactions without any additional foreign currency markup fees.

Pros: Good For International Transactions.

Cons: Nothing.

Min. Salary (Approx.): 30,000/month

Approval Rate: High

-1751437534.png)

Axis Flipkart Credit Card

Issuer: Axis Bank

Key Benefits: 7.5% Cashback & 5% Cashback on all transactions on Myntra & Flipkart

Pros: Top Cashback Offers

Cons: Cibil Score 730+

Min. Salary (Approx.): 25,000/month

Approval Rate: Moderate

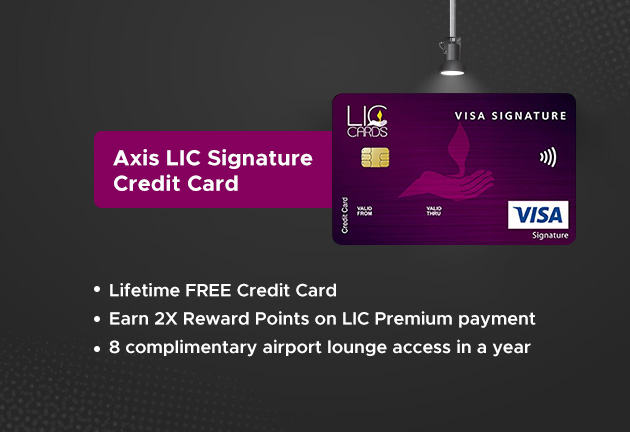

Axis LIC Signature Credit Card

Issuer: Axis Bank

Key Benefits: Lifetime FREE (No Joining/Annual fees)

Pros: 8 complimentary airport lounge access in a year

Cons: New to Credit not allowed.

Min. Salary (Approx.): 45000/Month.

Approval Rate: Moderate

**Disclaimer:** Minimum salary and approval rates are approximate and depend on various factors including your credit score, existing banking relationships, and the bank's internal policies. Always check the official bank website for the most current and accurate terms.

Deep Dive: Featured Lifetime FREE Cards

IDFC FIRST Credit Card

The IDFC FIRST Credit Card is an exceptional lifetime-free card designed to offer maximum value without any joining or annual fees. It is ideal for salaried and self-employed individuals earning above 25,000 per month and with a good credit score (750+). One of the most attractive benefits is that reward points never expire, which means users can save and redeem them at their convenience without any pressure. The card also allows interest-free ATM withdrawals for up to 48 days, a rare and user-friendly feature that adds to its utility. With wide acceptance and exclusive discounts on leading platforms like Flipkart, Myntra, Ajio, Tata CliQ, and Zomato, it's a smart choice for everyday savings and lifestyle benefits

Users can also enjoy a host of value-added benefits such as up to 10X reward points on spending, a 500 gift voucher on spending 15,000 in the first 90 days, and 25% discount on movie tickets via the Paytm app.

Why Choose This Card?

- Lifetime Free – No Joining or Annual Fee

- Reward Points Never Expire.

- Up to 10X Rewards, Lounge Access & Big Brand Discounts.

RBL Bank Shoprite Credit Card

The RBL Bank Shoprite Credit Card is a smart, zero joining fee credit card tailored for individuals who want to save on everyday essentials—especially groceries. It's perfect for salaried or self-employed individuals with a minimum monthly income of 15,000 and a credit score of 720 or above. The card offers 20 reward points for every 100 spent on grocery purchases

1 reward point per 100 on other purchases and 10% discount on BookMyShow movie tickets (up to 100) up to 15 times a year

Why Choose This Card?

- Earn 20 Reward Points on Grocery Shopping

- 10% Discount on BookMyShow (Up to 15 times/year)

- Fuel Surcharge Waiver up to 100/month

IDFC FIRST WOW Credit Card

This Card is a lifetime free credit card designed for individuals with no prior credit history or income proof—making it the perfect first credit card for beginners. It comes with guaranteed approval when backed by a fixed deposit, allowing you to set your own credit limit. A standout feature is that reward points never expire, giving users the freedom to redeem them anytime. Cardholders can also withdraw cash from ATMs with zero interest for up to 48 days, and earn an impressive 7.5% interest on their FD, adding more value to their savings.

Including 50% off on BookMyShow movie tickets, up to 20% discounts on 1500+ restaurants, and zero forex markup fees for international travelers. With attractive deals from Flipkart, Myntra, AJIO, Zomato, and travel portals like Yatra, MMT, GoIbibo, it caters to both lifestyle and travel enthusiasts. It also includes a 1% fuel surcharge waiver and a personal accident cover of 2 lakhs

Why Choose This Card?

- Lifetime Free – No Credit History Needed.

- Reward Points Never Expire + FD-Based Limit.

- 50% Off on Movies, 0% Forex Fees & Restaurant Discounts.

Why Choose a Lifetime FREE Credit Card?

Zero Annual Fees, Forever

The most obvious benefit! Keep more of your hard-earned money in your pocket, year after year.

Build Your Credit Score

Responsible usage helps establish and improve your credit history, crucial for future loans.

Rewards & Cashback

Earn points, cashback, and discounts on your everyday spending with no cost to maintain the card.

Safety & Convenience

Safer than carrying cash, offers purchase protection, and is perfect for online transactions.

Access to Premium Offers

Enjoy dining discounts, movie ticket offers, airport lounge access, and more, depending on the card.

Financial Flexibility

Access to credit for emergencies or large purchases, often with an interest-free period.

Frequently Asked Questions

It means you pay zero joining fees and zero annual fees for the entire time you hold the credit card. There are no hidden charges just for owning the card. However, standard charges may still apply for specific services like cash advances or late payment fees if you don't pay your bill on time.

The main "catch" is that these cards often have specific eligibility criteria (like a minimum income or credit score). Banks offer them for free hoping you'll use the card frequently, which generates transaction fees from merchants. As long as you pay your bills on time and in full, these cards remain truly free and beneficial for you.

Requirements vary by bank and card. Generally:

- Minimum Salary: Can range from ₹15,000 to ₹50,000+ per month for salaried individuals.

- Credit Score: A score of 750 or above is typically considered excellent and increases approval chances. Some cards (like secured cards) are designed for those with no credit history.

Applying is simple!

- Choose a card from the comparison above that fits your spending habits and eligibility.

- Click the "Apply Now" button next to your chosen card. This will redirect you to the bank's secure application page.

- Fill out the online application form with your personal, employment, and financial details.

- Submit any required documents digitally (e.g., PAN card, Aadhaar card, salary slips).

- The bank will review your application and typically provide a decision quickly, often within a few days.

Yes, but only slightly and temporarily. When you apply, the bank will perform a "hard inquiry" on your credit report to check your creditworthiness. This inquiry may cause a small, temporary dip (a few points) in your score. However, if you are approved and use the new card responsibly (paying bills on time), your score will recover and likely improve over the long term. Avoid applying for multiple cards in a very short period.

Stop Paying Annual Fees. Start Earning Rewards.

Compare the best offers, choose your perfect card, and apply in minutes. Your financial upgrade is just a click away.

👉 Find My Lifetime FREE Card Now!100% Secure Application | No Hidden Fees